Car insurance FAQ

-

How can I provide my driver number?

It's easy to provide your driver number. Simply use our driver number form to enter your driver number along with any other driver who is named on your policy.

You’ll will need to have your policy number and registration number to hand.

Why do I need to provide my driver number?

There is a change in road traffic legislation coming in December 2024, that will require you to provide your insurance company with the driver number for everyone on your policy.

To make things easier when it comes to your renewal, we’re asking all our car and van customers to provide their driver numbers ahead of time.

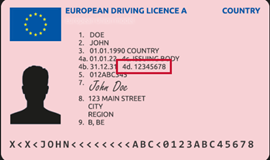

Where can I find my driver number?

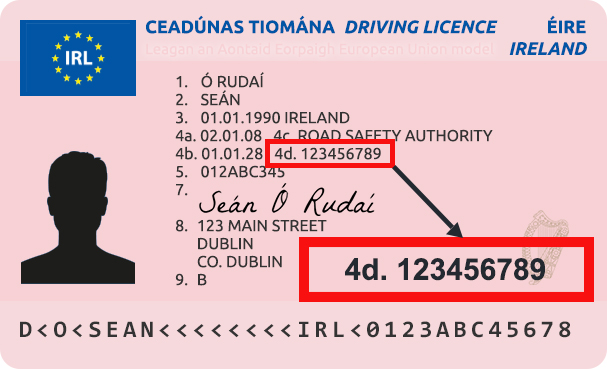

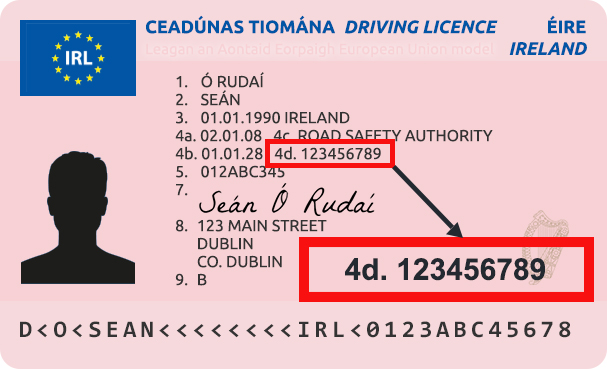

You can find your driver number in field 4d on the front of your driving licence, like in the image below.

Driving Licence

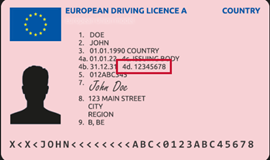

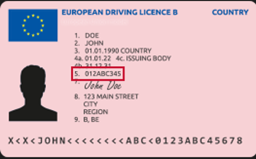

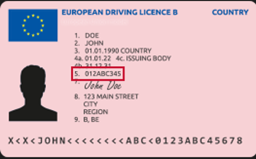

What if I have an EU licence?

All EU licences are slightly different, but your driver number is usually located in field 4d or 5 of your licence.

EU Driving Licence A

EU Driving Licence B

-

What is car and key rescue?

Car Rescue

Car rescue will cover you when your car breaks down. We will arrange roadside assistance, towing and help you to complete the journey if the repairs cannot be completed on the same day. You can contact our 24-hour car rescue line on 0818 7 365 24 or 00353 1 858 3200 from the UK.

Car rescue is an optional extra and an additional charge will apply if you want to buy this cover. Terms and conditions apply.

Key Rescue

Key rescue provides up to €1,500.00 (inc. VAT) towards lock and key replacement (including reprogramming of alarms and immobilisers) and costs of transportation in the event of lost or stolen keys or keys broken in any lock of your car. We will also cover up to €40.00 (inc. VAT) per day for up to 3 days for car hire if you are stranded more than 30 kilometres away from home or alternatively we will cover reasonable public transport or taxi fares for you and up to 4 passengers.

Key rescue is an optional extra and an additional charge will apply if you want to buy this cover. Terms and conditions apply.

Your Schedule will show if you have this cover. You can view this document through your MyAXA account. To register for MyAXA, please visit here.

-

How can I check if my monthly payment has been taken out of my bank account?

All monthly payments are taken from your bank account on the first working day of the month.

If for some reason your payment wasn't successful, please read "I missed a monthly payment, what should I do?"

-

How do I make a payment on my policy?

You can make a payment on your policy by completing our online payment form. Simply select from the list the type of payment you'd like to make. All you need is your policy number and your email address.

We'll send your receipt by email so you'll have the peace of mind the payment has gone through.

Alternatively, you can give us a call on 0818 7 365 24 to make a payment or you can drop into your local branch.

-

How do I report a claim if I am involved in an accident?

We understand that having to report a claim can be a stressful and we are here to try and make that process as easy for you as possible.

We offer a number of ways for you to report a claim.

You can report a claim online by simply filling out our online claims form or through your MyAXA account and a member of our team will be in contact with you at a time that best suits you.

You can also call our dedicated car insurance team on 0818 7 365 24 and they will be on hand to assist you throughout the claims process to make it as easy for you as possible.

Alternatively, you can visit your local branch, where a member of the team will be able to guide you through the claims process in person.

It is important to report a claim regardless of if there has been damage to your vehicle or not.

-

I've missed a payment on my policy, what should I do?

If you miss your monthly payment, we will notify you by email and/or by letter. Please refer to this correspondence for next steps.

In most cases we will reapply to your bank for a second time within 10 days. You can make the payment now and select "Pay missed monthly instalment" from the drop down menu.

Please confirm with your bank prior to paying again as payments may have already been requested a second time.

-

How do I report a windscreen claim?

To report a windscreen claim you can fill in our claims form or you can call us on 0818 7 365 24.

Please make sure you have policy number at hand.

-

Do I have to report every incident or claim?

Yes, you should report any incident which may result in a claim. Even if you're not sure whether a claim will be made on your policy. Incidents reported to us that don't result in a claim, won't impact your no claims discount.

You can complete our online claims form to notify us about a claim or an incident.

-

Can I cancel my policy mid term?

You’re free to cancel your policy mid-term. Simply return your Certificate of Insurance and Insurance Disc along with a written request to:

Postal Address:

AXA Insurance dac,

Wolfe Tone House,

Wolfe Tone Street,

Dublin 1,

D01 HP90You can also call us on 0818 7 365 24 or drop into your local branch.

You’ll find more information on cancellations and related charges in your policy booklet.

-

What happens if my car is written off after an accident?

If your car is written off as a result of a claim, we will settle your claim by replacing your car or by offering you the market value (or purchase price of your car whichever is lower) of your car at the time of the incident.

Our engineers will carry out the research to assess the appropriate market value of your car. We may then take ownership of the damaged car and you must send all items relating to the car, including the licensing documents and keys.

Terms and conditions apply. To find out more you can read your policy booklet under section Loss and damage to your car.

-

What is comprehensive driving of other cars?

Comprehensive Driving of Other Cars is an optional extra you can add to your car insurance. When you choose this cover, you can enjoy the same comprehensive cover you have on your own car insurance policy when driving other cars that are not owned, hired or leased by you or your partner.

Please note: There is a €50,000 limit on the borrowed car.

Please refer to your policy booklet for more details.

Your policy schedule will show the level of cover on your policy. You can view this document through your MyAXA account. To register for MyAXA you'll need your policy number, email address and date of birth.

-

What is open driving?

Open driving covers any driver aged between 25-70 with a full Irish, UK, EU licence to drive your car with your permission.

Open driving is an optional extra and an additional charge will apply.

Terms and conditions apply.

Your Schedule will show if you have this cover which you can view and download from the My Documents section of your MyAXA Account.

-

How can I get my no claims discount letter?

Your no claims discount letter is attached to your renewal letter.

You can also access it through your MyAXA account 30 days prior to your renewal. To register for MyAXA, you simply need your policy number, date of birth and email address.

You can also request your documents to be sent to you by post by completing the request a document form.

-

Can I change the car on my policy just for few days when my car is in repair?

Yes, if your car is in for repair you can make a temporary change of car through your MyAXA account.

If you don't have a MyAXA account you can do a temporary change of car through our express self-service. You'll need your policy number, email address and date of birth.

You’ll receive an email and text message confirming the change has been made.

For more help, we’ve put together this short guide on changing your car with MyAXA.

-

What's the difference between Comprehensive and Third Party, Fire and Theft cover?

Comprehensive covers:

- Damage by fire or theft

- We will also pay any claims or expenses arising from legal action brought against you following a road accident. There is no limit on the amount of personal injury claim settlements we pay on your behalf. If you damage someone else's property, there is a limit of €30 million.

- Accidental damage caused by you or others

- Malicious damage or vandalism

- Windscreen repair or replacement cover

Third Party, Fire and Theft covers:

- Damage by fire or theft

- Any claims or expenses arising from legal action brought against you following a road accident. There is no limit on the amount of personal injury claim settlements we pay on your behalf. If you damage someone else's property, there is a limit of €30 million.

You’ll find more details in your policy booklet.

-

Am I covered to tow a trailer on my Car Insurance policy?

Yes. Third Party liability cover to tow a single axel trailer is automatically included with AXA Car Insurance as standard.

Please note: This cover only applies when the trailer is attached to your vehicle or if it becomes detached in the course of a journey.

Terms and conditions apply.

You’ll find more details in your policy booklet.

-

What Car Insurance cover options does AXA offer?

We offer the choice of three levels of Car Insurance cover which you can choose from depending on your needs.

Third Party Only – this is the standard car insurance cover that is required by law. It covers damages to the third parties involved when an accident occurs.

Party, Fire and Theft – this is our mid-level cover which provides coverage for fire and theft, as well as damage to third parties involved.

Comprehensive – our comprehensive cover provides a more complete coverage. It includes all that is covered in third party fire and theft, plus additional benefits such as windscreen or misfuelling cover.

Read more about our Car Insurance cover option.

-

Can I get Car Insurance as a learner driver?

As a learner driver we're here for you every step of the way, from helping you complete your driving lessons to taking the driving test.

Along with providing learner drivers with insurance, we have also teamed up with the Irish School of Motoring to help keep the costs of learning to drive low for you.

If you choose us for your Car Insurance as a learner driver, you can get 12 EDT-approved lessons from €495, along with AXA Test Drive and a learner driver guide, for free.

Read more about our Young Driver Insurance.

-

Can I get a Car Insurance quote if I don’t have a car registration number yet?

If you're shopping around for a car, and don't know the exact registration number, you can still get an estimated Car Insurance quote by entering the make and model of the car you're looking at.

Once you've bought the car and have the registration number, we'll be able to give you an accurate price and you can choose to go ahead with the insurance.

Any quote you get will be based on an agreed set of assumptions.

-

Am I covered for a courtesy car after an accident if my own car is in for repair?

Yes, if your car is repairable and we are dealing with your claim, a Courtesy Car will be provided to you while repair to your car is being carried out by an AXA approved repairer. However long it takes.

Read more about your Car Insurance.

-

What is no claims discount protection?

No claims discount protection is an optional extra you can choose on your Car or Van Insurance for an extra cost.

It means you can rest easy knowing you can make one claim on your insurance policy without it affecting your no claims discount.

You must have earned a maximum no claims discount to add this cover and it can only be added at the start of a new policy, or when you are renewing your current AXA policy.

Terms and conditions apply.

Visit our Car Insurance or Van Insurance pages for more information.

-

How long can a driver be temporarily added to my Car Insurance?

You can add a driver for up to 28 days in any insurance year on your Car Insurance policy.

To add a driver on a temporary basis call us on 0818 7 365 24 or drop into your local branch.

-

Do I have no claims discount protection on my car insurance?

If you have more than 5 years claim free and have earned the maximum no claims discount, it makes sense that you'll want to keep it protected.

No claims discount protection is a perfect way of making sure that if you do have an accident, your discount will not be removed.

We offer no claims discount protection as an optional extra on your car insurance. This means that at an additional cost you can protect your no claims discount from being affected if you make one claim in the insurance year.

Your policy schedule will show if you have protected no claims discount which you can view in your MyAXA account.

For more information on your no claims discount protection, read your policy booklet under ‘Protected no claims discount’.

-

What documents do I need to send for my Car Insurance?

We will advise you which documents to forward when you set up your policy.

You’ll also be able to see a list of these documents, along with the ones that you have left to submit, through your MyAXA account. To register for MyAXA please visit here.

Some of the documents we may request include:

Driver licence:

ROI and UK licence holders will have to provide their driver licence number. Licences issued outside the ROI and UK must provide the original document. Terms and conditions of the licence must be adhered to. To check the validity of your licence please contact the National Driver Licence Service (NDLS).

Driving history:

No claims discount

If you have a no claims discount earned in your own name, we will require the original document confirming the number of years without claims, claims details, matching vehicle registration and expiry date. Please refer to FAQ "What is no claims discount?" for more details.

Driving experience earned as a named driver

If you were named on another policy as a named driver, we will ask you to provide a letter from your previous insurer confirming drivers named, period of cover and details of any claims disclosed.

Driving experience earned on a company car

If you were driving a company car, we will ask you to provide a letter from the insurance company confirming that you were covered on the company policy, number of claim free years and the period of cover.

We will also ask that you provide a letter from your employer confirming the following:

- Period of cover

- Full time exclusive use of the vehicle

- Exclusive use of the vehicle

- No claims made on the vehicle during this period of time

- Confirmation that you no longer have the use of the company car

Details of previous claims:

If you have any previous claims, we will ask you to provide a letter from your previous insurer outlining date of loss, claim type, status and settlement amount of the claim.

Please note: that we may also ask you to forward additional documentation. This will be explained to you at the time of purchase.

-

Am I covered to drive abroad?

If you're planning to travel abroad within the EU and bring your car with you, you can rest assured that you're covered. Our Car Insurance covers you to drive in the following countries: Republic of Ireland, Northern Ireland, Great Britain, Isle of Man and the Channel Islands. Your policy is also automatically extended to cover you to travel to EU member states for up to 90 days in any period of insurance.

Please note: Some of the sections of your policy cover apply only while driving in the Republic of Ireland, Northern Ireland and Great Britain.

Please call us on 0818 7 365 24 or drop into your local branch if you are in any doubt regarding your cover.

Terms and conditions apply.

You’ll find more details in your policy booklet.

-

I'm thinking of changing my car, can I get a quote?

If you're thinking about changing your car, you can get an estimation of how much it will cost in your MyAXA account.

If you don't have a MyAXA account, you can get an estimation to change your car through the express self-service.

All you need is your policy number, email address and your date of birth.

Changes to your car may affect the cost of your Car Insurance.

-

When will I get my refund?

If you're due a refund on your policy and you pay by monthly instalments, we'll send the refund to your bank account within 3-5 working days.

If you've paid your policy in full, we'll send your refund by cheque in the post to your home address. This can take up to 10 working days.

If you think you should have received your refund by now, give us a call on 0818 7 365 24 or drop into your local branch.

-

I haven't received my Certificate of Insurance and disc?

You should receive your cert and disc in the post within a few days of taking out your insurance policy. If you haven't received your cert and disc it will be available in your MyAXA account to view and download.

You can also get a copy by completing the document request form.

If you're unsure of what documents you need to send, you can log into your MyAXA account where your outstanding documents are listed. You can also call us on 0818 7 365 24 or drop into your local branch where one of the team will be happy to help.

-

Am I covered if personal belongings are stolen from my car?

If you have Comprehensive, or Third Party, Fire and Theft cover on your Car Insurance, you will be covered if personal are stolen from your car subject to a limit of €750.

A claim under this section will not affect your no claims discount. Your policy schedule will show you if this cover which you can find in your MyAXA account.

Please note that some items are not covered, for example:

Money

Tickets

Jewellery

You are not covered for personal belongings if your car is left unattended and it's unlocked or the windows or sunroof are left open.

You’ll find more details in policy booklet.

Terms and conditions apply.

-

How can I get a letter of named driving experience?

You can request a copy of your named driving experience by completing the document request form.

You will need the following:

- Policy number

- Full name of the policy holder

- Email address associated with the account

The named driving experience letter will be sent by post to the policy holders address.

Alternatively you can give us a call on 0818 7 365 24 or drop into your local branch and one of the team will be happy to help.

-

Where should I send documents relating to my claim?

The easiest way to send us your documents is to take a photo of each, unless the orginal document is requested, and upload them through your MyAXA account.

To register for MyAXA you'll need your policy number, email address and date of birth.

Alternatively, you can send them as attachments by email to claims@axa.ie. Please include your claim number in the subject line of the email followed by "i" (e.g. 123456789i).

You can also drop them into your your local branch, or post them to:

Claims Department,

AXA Insurance dac,

Wolfe Tone House,

Wolfe Tone Street,

Dublin 1

D01 HP90 -

When can I pay the settlement balance on my policy?

You can pay the settlement balance on your policy any time either by contacting us on 0818 7 365 24 or by dropping into your local branch.

If you are a car or home customer, you can view your payment information through your MyAXA account.

To register for MyAXA you'll need your policy number, email address and date of birth.

-

Am I covered if I leave my keys in my car or van, and it is stolen?

Unfortunately, loss or damage caused by theft or attempted theft is not covered if the keys (or keyless entry system) are left unsecured or left in or, on an unattended vehicle.

You should never leave your vehicle unattended with the keys in or around the vehicle.

You’ll find more details in your policy document.

Terms and conditions apply.

-

I hold a provisional licence, can I drive on my own?

By law, you are not allowed to drive on your own if you hold a provisional Irish licence or learner permit. For your own safety you must always be accompanied by a fully licenced driver, who has held their full licence for a minimum of 2 years.

-

Where should I send my documents for my car insurance?

The easiest way to send us your documents is to take a clear photo of each item, then you can simply upload them through;

You can also send them by email to axadocuments@axa.ie, drop them into your local branch or send them by post to:

AXA Insurance dac,

Wolfe Tone House,

Wolfe Tone Street,

Dublin 1,

D01 HP90From time to time we may request to see the original documentation. If you've been asked to send in the originals, you can drop into your local branch or send them to the address above.

-

I've sent in my documents, when will I hear back?

We usually process documentation within 2 days of receiving them.

If it's been more than 2 days and your documents are still showing as outstanding on your MyAXA account, please get in touch with one of the team on 0818 7 365 24.

-

How do I add a driver temporarily to my Car Insurance policy?

You can add a temporary driver to your policy for up to 28 days. Simply call us on 0818 7 365 24 or drop into your local branch.

Please note: Changes to your policy may affect your annual premium.

-

Can someone else discuss my claim on my behalf?

We won't discuss your claim with anyone else without your permission.

To give another person permission to discuss your claim on your behalf, please call us on 0818 7 365 24 and one of the team can help you.

-

What is Comprehensive Car Insurance cover?

Comprehensive Car Insurance is the highest level of cover you can get, and it's the most popular choice for our customers.

Comprehensive Car Insurance covers you for third party claims after an incident and for damage caused to your own vehicle. With our comprehensive cover, the following are included as standard:

- Replacement car cover

- Injury cover

- Legal expense cover

- Glass cover

- Driving of other cars (if you were 25 or over at inception or renewal). Exclusions may apply.

You’ll find more details in your policy booklet.

Your Schedule will show the level of cover on your policy. You can access this document through your MyAXA account. To register for your MyAXA Account, you'll need your policy number, email address and date of birth.

-

When is my renewal date?

You can find your renewal date on your Certificate of Insurance or your policy Schedule.

You can view and download your policy documents through your MyAXA account.

We'll be in touch with your renewal notice approximately 3 weeks in advance of your renewal date. If you've previously paid by direct debit then your policy may renew automatically. You can check your MyAXA account to confirm if you have automatic rollover.

-

What does windscreen cover provide?

Windscreen (or glass) cover means we will pay the cost of repairing or replacing cracked, broken or damaged windscreens or windows in your car.

We'll also cover any scratches to the body work as a result of broken glass.

Your schedule will show if you have this cover which you can find in your MyAXA Account.

If you have a glass breakage and wish to make a claim, you can complete our claims form or call us on 0818 7 365 24.

All claims must be verified prior to any repair/replacement work being undertaken.

Terms & Conditions apply. Damaged or broken glass in sunroofs, panoramic glass roofs and mirrors is not covered. Glass claims will not affect your no claims discount.

You'll find more information on glass cover in your policy document.

-

If I use my car to drive to or from work what class of use should I have on my policy?

If you use your car to commute to and from work, you should have Social Domestic and Pleasure plus Commuting cover on your policy. Section 3 of your certificate of insurance will show the class of use you have on your policy.

You can view and download your 'Certificate of Insurance' in your MyAXA account.

To register for MyAXA you'll need your policy number, email address and date of birth.

-

What is an accidental damage claim?

An accidental damage claim is typically where the policy holder will claim for costs to cover accidental damage to their vehicle under their Motor or Van Insurance policy.

You will find more information in your policy booklet.

-

I got a quote online but I would like to update it?

You can use your quote reference to retrieve your quote and make the required changes.

You'll be provided with the quote reference once you complete your quote online. You'll also receive the quote reference by email.

-

What is Replacement Car cover?

If your car is damaged in an accident but is still repairable, we'll provide you with a replacement car while yours is being repaired, for however long it takes.

Check your schedule to see if you've got replacement car cover, which you can view and download from your MyAXA account.

This cover will apply if there is a valid claim under the comprehensive or the Fire & Theft section of your policy.

Terms and conditions apply. An AXA approved repairer must be used.

-

What is an excess?

An excess is the first part of a claim that you will have to pay.

For example, if you have an excess of €100 and make a claim worth €1,000, we will pay €900 of the claim settlement amount and you'll be asked to pay the €100 excess amount.

Your excess amount is noted on your policy schedule.

Car and Home Insurance customers can view their policy schedule in their MyAXA account.

To register for MyAXA you'll need your policy number, date of birth and email address.

-

What is Third Party, Fire and Theft cover?

Third party, Fire and Theft is a level of cover you can choose on your motor insurance.

With Third Party, Fire and Theft, we cover you against damage caused to your car by fire, theft or attempted theft. It includes your legal liability to others; up to €30 million for property damage and unlimited liability cover for injury to others.

Third Party Fire and Theft doesn't cover accidental damage caused to your vehicle.

Your policy documents will show the level of cover you have on your car insurance. You'll find these in your MyAXA account.

You’ll find more information about Third Party, Fire and Theft cover in your policy booklet.

-

I've re-registered my UK car in the Republic of Ireland, how do i update my car registration number?

To update your car registration, simply call us on 0818 7 365 24 or drop into your local branch.

-

I've lost my card - do I need to update my payment details?

If you get a new card you don't need to contact us, as long as your bank account details haven't changed.

If you need to, you can update your bank details online.

Alternatively, you can get in touch on 0818 7 365 24 or drop into your your local branch.

-

Why did I get a letter to say documents are outstanding?

If you've recently received a letter to say your documents are outstanding and you've already sent them to us, we may not have got to them yet as it can take up to 2 days to process.

You can check if your documentation is still outstanding in your MyAXA account.

If you need to speak to a member of the team you can give us a call on 0818 7 365 24 or drop into your local branch.

-

What is a voluntary excess?

A voluntary excess is the amount you agree to pay in the event of an accident. You can choose to increase or decrease your excess. The higher your voluntary excess, the lower your quote will be. Similarly, lowering the excess will increase the cost of your car insurance.

Please note: Car policy holders under the age of 25 cannot reduce their excess.

The excess amount is noted on your Schedule. You can view this document through your MyAXA account.

To register for MyAXA, you'll need your policy number, date of birth and email address.

-

Can you settle a claim without my agreement?

We'll always try to work with you to settle your claim to your satisfaction.

To help us with your claim, you must give us or our appointed representative any information or documentation required to investigate the claim.

In the event where we can't reach agreement, we may take over and deal with the defence or settlement of any claim for you or the driver.

-

Do you provide insurance for young drivers?

Yes, we are Ireland’s leading motor Insurance provider for young drivers.

When you’re covered with our Young Drivers Insurance, you’ll get peace of mind and our best price online.

-

My policy is up for renewal - how can I cancel it?

Your policy won’t renew unless we receive a payment. So if you've previously paid in full, there’s nothing you need to do. Your policy will automatically expire.

If you paid by monthly direct debit, simply call us on 0818 7 365 24 or drop into your local branch.

You’ll find more detailed instructions in your renewal letter.

-

Can I get my proof of no claims discount sent by email?

Unfortunately not. Your proof of no claims discount is included in your renewal pack. We can also send you a copy by post by completing the document request form.

Alternatively, you can call us on 0818 7 365 24 or drop into your local branch and the team will be happy to help.

-

I have a temporary car on my policy - can I extend the cover?

You can extend or cancel your temporary cover any time through your MyAXA account.

To register for your MyAXA account you'll need your policy number, email address and date of birth.

-

If I buy Car or Home Insurance online, when will i get my documents?

Your policy documents will be available once the initial payment is made and you can download them through your MyAXA account. If you haven't got an account you can easily register for MyAXA.

You can also download your documents through express self-service, all you need is your policy number, email address and date of birth.

Please note: You will also receive your documents in the post within 5 working days.

-

How do I make a change to my Car Insurance policy?

You can make most changes to your Car Insurance policy in your MyAXA account. To view a list of all the changes you can make visit manage your policy.

To remove a driver, cancel your policy or make changes to your renewal, call us on 0818 7 365 24 or drop into your local branch.

Please note: Changes to your policy may affect your annual premium.

-

I haven't bought the car yet - can I still get a quote?

Yes, you can still get a Car Insurance quote even if you haven't bought the car or if you're still deciding which car to buy. We know that the cost of insuring a car is an important consideration when buying a new car.

To get a Car Insurance quote, just enter the registration if you have it. If you don't have the registration you can enter the make and model details. Once you've bought the car, you can insure it in your own name.

-

What is a theft claim?

A theft claim is where you make a claim on your policy if your vehicle has been stolen or there’s been an attempted theft of your vehicle.

If your car or van is stolen, you should contact us on 0818 7 365 24 as soon as you can to report the incident. You must also tell the appropriate law enforcement authorities.

Theft claims don't affect your no claims discount.

You will find more information in your policy document.

-

How can I change my direct debit details?

You can change your direct debit details by using our online change bank details form.

Alternatively, you can call us on 0818 7 365 24 or drop into your local branch.

-

Where can I find my policy renewal date?

You can find your expiry date on your policy documents which are available in your MyAXA account.

If you don't have a MyAXA account and think your policy is expiring soon, give us a call on 0818 7 365 24 and one of the team will be happy to help.

We will send out your renewal invite by post approximately 4 weeks before your renewal date.

-

Am I covered if my car breaks down?

We know that sometimes your car can break down when you least expect it, that's why we offer Car and Key Rescue as an optional extra that can help you avoid this stress and have peace of mind that you are protected, should the unexpected happen.

Car and Key Rescue can be added to your policy at an additional cost and covers you for home starts and roadside assistance so you can get on with your day with minimal disruption.

If you need us, give us a call on 0818 7 365 24, and we will arrange roadside assistance for you. This includes towing and assistance if you need to complete your journey and the repairs cannot be completed in the same day.

Your schedule will show if you have this cover. You have access to all your policy documents in your MyAXA account.

Read more about cover options available on your car insurance.

-

Do I have windscreen cover?

If you have Comprehensive Car Insurance policy with us you can rest assured that you have windscreen cover.

If you have broken glass coverage and would like to make a claim, either complete the online claims form or call us on 0818 7 365 24 before you proceed with fixing the damage.

We will then advise you to contact one of our AXA approved repairers and the repairs will be fully covered.

If you decide to use your own repairer, we will cover a replacement of up to €400, or a repair of up to €50.

Terms and conditions apply.

-

What should I do if someone wants to report a claim against my policy?

You or your legal representative must give us full details within 48 hours of any event which could lead to a claim under this policy. To report a claim complete our online claims form or call the claims helpline 0818 7 365 24.

You must also immediately send us any letters and documents you receive in connection with the event without replying to them. If there is another car involved you should swap details with the other driver. Never accept liability without discussing with your claims handler.

-

What is injury to driver cover?

Injury to driver cover provides cover for you and any named driver in the event of injury or death.

Terms and conditions apply.

Your Schedule will show if you have this cover.

You can view and download your documents through your MyAXA account. To register for MyAXA, you'll need your policy number, email address and date of birth.

-

How can I remove a driver from my policy?

To remove a driver from your policy at your renewal call us on 0818 7 365 24 or drop into your local branch.

Please note: If you'd like to remove a driver mid-term, you'll be asked to return your insurance cert and disc to the address below.

AXA Insurance dac,

Wolfe Tone House,

Wolfe Tone Street,

Dublin 1,

D01 HP90 -

My car was stolen, what should I do?

If your car has been stolen you should contact the Gardai as soon as it's safe to do so.

Once you've reported the theft, you should call our claims line on 0818 7 365 24 and one of the team will record the incident and talk you through the next steps.

-

I can't see my Certificate on MyAXA?

You can access your Certificate of Insurance from the My Documents section of your MyAXA account

If you can't see your Certificate there could be a technical issue so please get in touch on 0818 7 365 24 so we can help you troubleshoot the problem.

-

How do I amend my car policy from a provisional to a full licence?

To amend your policy from a provisional to a full licence, simply call us on 0818 7 365 24 or drop into your local branch.

-

I have lost my car keys - what should I do?

If you've lost your car keys you should notify our claims team on 0818 7 365 24.

If you have chosen Car and Key Rescue we will cover lost, damaged or stolen car keys. This cover provides up to €1,500.00 (Inc. VAT) towards lock and key replacement.

It also provides up to €40.00 (inc. VAT) per day for up to 3 days for car hire in the event that you are stranded more than 30km away from home. Alternatively, it provides reasonable public transport or taxi fares for you and up to 4 passengers.

You can check if you have Car and Key Rescue included on your policy schedule which you can view and download from your MyAXA Account.

Register your claim for lost, stolen or damaged keys.

-

What type of claims don't affect my no claims discount?

If you're a car customer, the following claims will not affect your no claims discount:

- Fire

- Theft (or attempted theft)

- Windscreen/glass breakage

- Loss/damage to personal belongings

- Fire brigade charges

- Car and Key Rescue

You’ll find more details in your policy booklet.

-

How can I add a driver to my Car Insurance policy?

You can add a driver to your Car Insurance through your MyAXA account.

If you don’t have an account you can add a driver through express self-service. You'll need your policy number, email address and date of birth.

You'll also need personal details of the additional driver, claims experience and driving history along with the drivers permission to get a quote.

For temporary additional drivers, give us a call on 0818 7 365 24 or drop into your local branch.

Need help? Check out our quick guide to adding a driver to your policy

-

I've just bought a new policy, can I cancel it?

If you've just bought a policy with us, you can cancel your policy within the first 14 days and we'll give you a full refund, provided that no claims have been made during this period.

You’ll find more information around policy cancellations in your policy booklet.

-

What is named driving experience?

If you are named as a driver on another policy, you can earn a discount for each year you have been named and are claim free.

We will reward you with a named driving experience discount up to a maximum of 6 years if each year is continuous without gaps.

You can get a car insurance quote online, just make sure to select 'insured as a named driver' when asked about your previous insurance.

If you're not sure how many years you're entitled to, call us on 0818 7 365 24 and we'll be happy to help. Or visit car insurance.

Terms and conditions apply.

-

I am thinking about buying a second car - will I be able to use my no claims discount again?

Unfortunately, you can't use your no claims discount twice.

However, if you are the only driver on both policies, you may be eligible for an introductory discount on your second car.

Get a Car Insurance quote for your second car or give us a call on 0818 7 365 24 if you need to speak to one of the team.

You'll find more information on our Car Insurance page.

-

Can I get a Car Insurance quote online if I'm a first time driver?

Yes, we offer insurance to first time drivers and drivers who have no previous insurance in their own name.

Read more about what's covered with our Car Insurance and how we support our young drivers.

To get a Car Insurance quote, simply select 'NO PREVIOUS INSURANCE' in the driving experience question.

Or you can give us a call on 0818 7 365 24 and one of the team will be happy to help.

-

Can I choose when my monthly instalment is collected from my bank account?

Unfortunately, you can’t change the collection date of your direct debit.

You can stop the payment from coming out of your account by making an early payment on your policy through our payment form.

Early payments should be made before the 25th of the month to stop the direct debit process. If you pay after the 25th of the month, the direct debit process will run as usual which means you could end up paying too much.

-

My monthly payment was taken twice, what should I do?

If your payment has been taken twice, the best thing to do is contact your bank directly. This is the quickest option as payment is normally back in your account on the same day. Simply request a SEPA cancellation and the bank will refund your direct debit payment accordingly.

Alternatively, give us a call on 0818 7 365 24 and we'll be happy to help.

-

Do I need a Green Card?

The UK Ministry of Transport has agreed that Green Cards will not be required for Irish vehicles travelling to the UK including Northern Ireland. It has been agreed that the insurance disc will be accepted as proof of insurance.

-

What is a multiproduct discount?

We offer a discount on your car insurance if you, or anyone living at your address has a car, home or van AXA direct policy.

We offer a discount on your home insurance if you have an existing van or car policy with AXA directly.

Please note: All discounts are subject to the minimum premium.

-

How can I check who is insured to drive my car?

You can find out who is insured to drive your car by checking section 6 of your Certificate of Insurance.

You can view and download your insurance documents from your MyAXA account.

You can also request a copy of your insurance certificate by completing the document request form.

Please note: Temporary drivers won't appear on your insurance certificate.

-

What is Third Party Only cover?

Third Party Only Car Insurance is our most basic cover option which means that third parties involved in an incident are protected. It's a legal requirement that you have at least Third Party Only car insurance in Ireland.

For example, if you had an accident with another driver (the third party) and the accident was your fault, then your liability to the driver of the other car would be covered. So we would cover the cost for the other drivers car, property and any personal injury.

With third party only, cover for your car is not included.

Your Schedule will show the level of cover on your policy. You can view and download your schedule in your MyAXA account.

To register for MyAXA you'll need your policy number, date of birth and email address.

-

Can I get an online quote if I've had no previous insurance?

Yes, we offer insurance to first time drivers and drivers who have no previous insurance in their own name.

Read more about our Car Insurance cover.

-

I'm due a refund, can I get it sent to my card?

If you pay by direct debit we can issue your refund to your bank account or if you pay in full your refund will be issued by cheque to your home address.

-

What is no claims discount?

No claims discount is the percentage discount you earn for each year you’ve been claim free on your own car insurance policy, up to a maximum of 75%.

Read more about the discounts we offer on our Car Insurance page.

-

What does automatic renewal mean?

When you choose automatic renewal, your policy will automatically renew on your renewal date each year. If you are happy with the renewal terms and the premium quoted there is no need for you to take any action.

Unless you contact us prior to the renewal date, your policy will renew, and your monthly instalments will continue to be debited. Car and home insurance customers can check if you have automatic renewal in your MyAXA account.

-

What is a third party claim?

A third party claim is when there is damage caused to another persons vehicle or property, or Injury to another person as a result of an accident.

You will find more information in your policy document.

-

How can I renew my policy?

If you pay by monthly direct debit, we'll automatically renew your car or home policy for you.

If you'd like to pay the full amount up front, you can do so by selecting 'Pay renewal in full' from the drop-down menu on our payment form. You can also renew your policy through your MyAXA account. To register for MyAXA, please visit here.

If you've paid in full previously and would now like to pay by direct debit, simply call us on 0818 7 365 24 or drop into your local branch.

Need help? We’ve put together a simple guide.

As a car or home customer, you can view your payment information any time through your MyAXA account.

-

Do I need to pay a deposit when I renew my policy?

Yes. Once you renew your policy, a 15% deposit will be taken from your account within 7 working days of your policy start date.

You'll find more details in your payment schedule.

You can view your documents through your MyAXA account.

To register for MyAXA, you'll need your policy number, email address and date of birth.

-

Why does my no claims discount show my policy as live?

If your no claims discount is showing as 'Live', this means your policy was active when it was issued. If you've since cancelled your policy you can request a new one through the document request form.

If you'd prefer you can call us on 0818 7 365 24, or drop into your local branch and we'll be happy to help.