Car insurance - FAQs

-

How can I provide my driver number?

It's easy to provide your driver number. Simply use our driver number form to enter your driver number along with any other driver who is named on your policy.

You’ll will need to have your policy number and registration number to hand.

Why do I need to provide my driver number?

There is a change in road traffic legislation coming in December 2024, that will require you to provide your insurance company with the driver number for everyone on your policy.

To make things easier when it comes to your renewal, we’re asking all our car and van customers to provide their driver numbers ahead of time.

Where can I find my driver number?

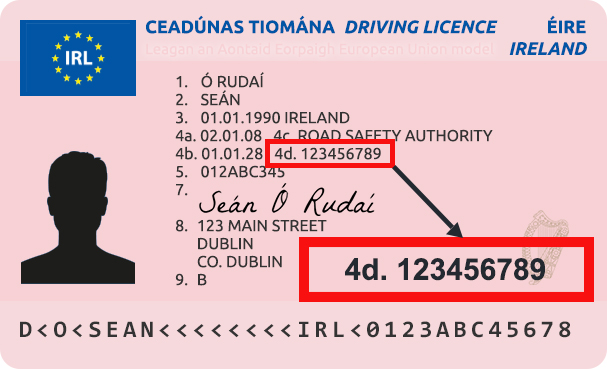

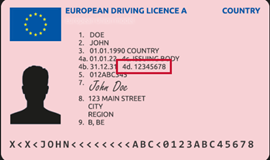

You can find your driver number in field 4d on the front of your driving licence, like in the image below.

Driving Licence

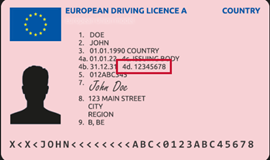

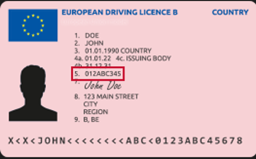

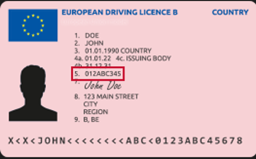

What if I have an EU licence?

All EU licences are slightly different, but your driver number is usually located in field 4d or 5 of your licence.

EU Driving Licence A

EU Driving Licence B

-

What is car and key rescue?

Car Rescue

Car rescue will cover you when your car breaks down. We will arrange roadside assistance, towing and help you to complete the journey if the repairs cannot be completed on the same day. You can contact our 24-hour car rescue line on 0818 7 365 24 or 00353 1 858 3200 from the UK.

Car rescue is an optional extra and an additional charge will apply if you want to buy this cover. Terms and conditions apply.

Key Rescue

Key rescue provides up to €1,500.00 (inc. VAT) towards lock and key replacement (including reprogramming of alarms and immobilisers) and costs of transportation in the event of lost or stolen keys or keys broken in any lock of your car. We will also cover up to €40.00 (inc. VAT) per day for up to 3 days for car hire if you are stranded more than 30 kilometres away from home or alternatively we will cover reasonable public transport or taxi fares for you and up to 4 passengers.

Key rescue is an optional extra and an additional charge will apply if you want to buy this cover. Terms and conditions apply.

Your Schedule will show if you have this cover. You can view this document through your MyAXA account. To register for MyAXA, please visit here.

-

What is open driving?

Open driving covers any driver aged between 25-70 with a full Irish, UK, EU licence to drive your car with your permission.

Open driving is an optional extra and an additional charge will apply.

Terms and conditions apply.

Your Schedule will show if you have this cover which you can view and download from the My Documents section of your MyAXA Account.

-

Can I get Car Insurance as a learner driver?

As a learner driver we're here for you every step of the way, from helping you complete your driving lessons to taking the driving test.

Along with providing learner drivers with insurance, we have also teamed up with the Irish School of Motoring to help keep the costs of learning to drive low for you.

If you choose us for your Car Insurance as a learner driver, you can get 12 EDT-approved lessons from €495, along with AXA Test Drive and a learner driver guide, for free.

Read more about our Young Driver Insurance.

-

Can I get a Car Insurance quote if I don’t have a car registration number yet?

If you're shopping around for a car, and don't know the exact registration number, you can still get an estimated Car Insurance quote by entering the make and model of the car you're looking at.

Once you've bought the car and have the registration number, we'll be able to give you an accurate price and you can choose to go ahead with the insurance.

Any quote you get will be based on an agreed set of assumptions.

-

What is no claims discount protection?

No claims discount protection is an optional extra you can choose on your Car or Van Insurance for an extra cost.

It means you can rest easy knowing you can make one claim on your insurance policy without it affecting your no claims discount.

You must have earned a maximum no claims discount to add this cover and it can only be added at the start of a new policy, or when you are renewing your current AXA policy.

Terms and conditions apply.

Visit our Car Insurance or Van Insurance pages for more information.

-

I hold a provisional licence, can I drive on my own?

By law, you are not allowed to drive on your own if you hold a provisional Irish licence or learner permit. For your own safety you must always be accompanied by a fully licenced driver, who has held their full licence for a minimum of 2 years.

-

What is Comprehensive Car Insurance cover?

Comprehensive Car Insurance is the highest level of cover you can get, and it's the most popular choice for our customers.

Comprehensive Car Insurance covers you for third party claims after an incident and for damage caused to your own vehicle. With our comprehensive cover, the following are included as standard:

- Replacement car cover

- Injury cover

- Legal expense cover

- Glass cover

- Driving of other cars (if you were 25 or over at inception or renewal). Exclusions may apply.

You’ll find more details in your policy booklet.

Your Schedule will show the level of cover on your policy. You can access this document through your MyAXA account. To register for your MyAXA Account, you'll need your policy number, email address and date of birth.

-

What is Replacement Car cover?

If your car is damaged in an accident but is still repairable, we'll provide you with a replacement car while yours is being repaired, for however long it takes.

Check your schedule to see if you've got replacement car cover, which you can view and download from your MyAXA account.

This cover will apply if there is a valid claim under the comprehensive or the Fire & Theft section of your policy.

Terms and conditions apply. An AXA approved repairer must be used.

-

What is an excess?

An excess is the first part of a claim that you will have to pay.

For example, if you have an excess of €100 and make a claim worth €1,000, we will pay €900 of the claim settlement amount and you'll be asked to pay the €100 excess amount.

Your excess amount is noted on your policy schedule.

Car and Home Insurance customers can view their policy schedule in their MyAXA account.

To register for MyAXA you'll need your policy number, date of birth and email address.

-

What is Third Party, Fire and Theft cover?

Third party, Fire and Theft is a level of cover you can choose on your motor insurance.

With Third Party, Fire and Theft, we cover you against damage caused to your car by fire, theft or attempted theft. It includes your legal liability to others; up to €30 million for property damage and unlimited liability cover for injury to others.

Third Party Fire and Theft doesn't cover accidental damage caused to your vehicle.

Your policy documents will show the level of cover you have on your car insurance. You'll find these in your MyAXA account.

You’ll find more information about Third Party, Fire and Theft cover in your policy booklet.

-

What is a voluntary excess?

A voluntary excess is the amount you agree to pay in the event of an accident. You can choose to increase or decrease your excess. The higher your voluntary excess, the lower your quote will be. Similarly, lowering the excess will increase the cost of your car insurance.

Please note: Car policy holders under the age of 25 cannot reduce their excess.

The excess amount is noted on your Schedule. You can view this document through your MyAXA account.

To register for MyAXA, you'll need your policy number, date of birth and email address.

-

Do you provide insurance for young drivers?

Yes, we are Ireland’s leading motor Insurance provider for young drivers.

When you’re covered with our Young Drivers Insurance, you’ll get peace of mind and our best price online.

-

I haven't bought the car yet - can I still get a quote?

Yes, you can still get a Car Insurance quote even if you haven't bought the car or if you're still deciding which car to buy. We know that the cost of insuring a car is an important consideration when buying a new car.

To get a Car Insurance quote, just enter the registration if you have it. If you don't have the registration you can enter the make and model details. Once you've bought the car, you can insure it in your own name.

-

Where can I find my policy renewal date?

You can find your expiry date on your policy documents which are available in your MyAXA account.

If you don't have a MyAXA account and think your policy is expiring soon, give us a call on 0818 7 365 24 and one of the team will be happy to help.

We will send out your renewal invite by post approximately 4 weeks before your renewal date.

-

What is injury to driver cover?

Injury to driver cover provides cover for you and any named driver in the event of injury or death.

Terms and conditions apply.

Your Schedule will show if you have this cover.

You can view and download your documents through your MyAXA account. To register for MyAXA, you'll need your policy number, email address and date of birth.

-

I've just bought a new policy, can I cancel it?

If you've just bought a policy with us, you can cancel your policy within the first 14 days and we'll give you a full refund, provided that no claims have been made during this period.

You’ll find more information around policy cancellations in your policy booklet.

-

What is named driving experience?

If you are named as a driver on another policy, you can earn a discount for each year you have been named and are claim free.

We will reward you with a named driving experience discount up to a maximum of 6 years if each year is continuous without gaps.

You can get a car insurance quote online, just make sure to select 'insured as a named driver' when asked about your previous insurance.

If you're not sure how many years you're entitled to, call us on 0818 7 365 24 and we'll be happy to help. Or visit car insurance.

Terms and conditions apply.

-

I am thinking about buying a second car - will I be able to use my no claims discount again?

Unfortunately, you can't use your no claims discount twice.

However, if you are the only driver on both policies, you may be eligible for an introductory discount on your second car.

Get a Car Insurance quote for your second car or give us a call on 0818 7 365 24 if you need to speak to one of the team.

You'll find more information on our Car Insurance page.

-

Can I get a Car Insurance quote online if I'm a first time driver?

Yes, we offer insurance to first time drivers and drivers who have no previous insurance in their own name.

Read more about what's covered with our Car Insurance and how we support our young drivers.

To get a Car Insurance quote, simply select 'NO PREVIOUS INSURANCE' in the driving experience question.

Or you can give us a call on 0818 7 365 24 and one of the team will be happy to help.

-

Do I need a Green Card?

The UK Ministry of Transport has agreed that Green Cards will not be required for Irish vehicles travelling to the UK including Northern Ireland. It has been agreed that the insurance disc will be accepted as proof of insurance.

-

What is a multiproduct discount?

We offer a discount on your car insurance if you, or anyone living at your address has a car, home or van AXA direct policy.

We offer a discount on your home insurance if you have an existing van or car policy with AXA directly.

Please note: All discounts are subject to the minimum premium.

-

What is Third Party Only cover?

Third Party Only Car Insurance is our most basic cover option which means that third parties involved in an incident are protected. It's a legal requirement that you have at least Third Party Only car insurance in Ireland.

For example, if you had an accident with another driver (the third party) and the accident was your fault, then your liability to the driver of the other car would be covered. So we would cover the cost for the other drivers car, property and any personal injury.

With third party only, cover for your car is not included.

Your Schedule will show the level of cover on your policy. You can view and download your schedule in your MyAXA account.

To register for MyAXA you'll need your policy number, date of birth and email address.

-

Can I get an online quote if I've had no previous insurance?

Yes, we offer insurance to first time drivers and drivers who have no previous insurance in their own name.

Read more about our Car Insurance cover.

-

What is no claims discount?

No claims discount is the percentage discount you earn for each year you’ve been claim free on your own car insurance policy, up to a maximum of 75%.

Read more about the discounts we offer on our Car Insurance page.

-

Why does my no claims discount show my policy as live?

If your no claims discount is showing as 'Live', this means your policy was active when it was issued. If you've since cancelled your policy you can request a new one through the document request form.

If you'd prefer you can call us on 0818 7 365 24, or drop into your local branch and we'll be happy to help.