It's easy to provide your driver number. Simply use our driver number form to enter your driver number along with any other driver who is named on your policy.

You’ll will need to have your policy number and registration number to hand.

Why do I need to provide my driver number?

There is a change in road traffic legislation coming in December 2024, that will require you to provide your insurance company with the driver number for everyone on your policy.

To make things easier when it comes to your renewal, we’re asking all our car and van customers to provide their driver numbers ahead of time.

Where can I find my driver number?

You can find your driver number in field 4d on the front of your driving licence, like in the image below.

Driving Licence

What if I have an EU licence?

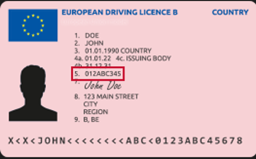

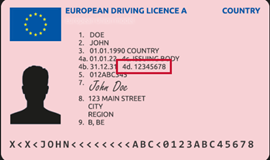

All EU licences are slightly different, but your driver number is usually located in field 4d or 5 of your licence.

EU Driving Licence A

EU Driving Licence B